By Jason Q. Freed

Blog

How LOS Analysis Improves Underwriting for Extended Stay Assets

By Jason Q. Freed and Rachael Rothman

Despite demand and revenue growth across the U.S. hotel industry slowing to a near standstill, owners and developers appear bullish over the long-term prospects of one particular segment: extended stay.

Supply growth in the segment hovers between 7% and 8%, largely outpacing the industry average, and a handful of new brands aimed at longer lengths of stay have debuted in recent months, including stayAPT Suites and Choice Hotels’ new brand, Everhome Suites. Choice CEO Patrick Pacious called extended stay “one of the fastest growing segments of the hotel industry” on a recent earnings call.

To take advantage of this attractive marketplace, a developer recently approached Kalibri Labs looking for a site selection sanity check on the potential development of an Upscale extended-stay hotel. The developer had identified Miami as a potential market, primarily using existing supply as the filter (aka: the old-fashioned way).

The developer was not wrong in taking a supply-driven approach. But the goal at the beginning – to find where white space existed on the map – was limiting. It required a cumbersome approach of checking location after location in an effort to identify a market with below average supply, and where the competitive set’s aggregate RevPAR would satisfy the developer’s hurdle rate.

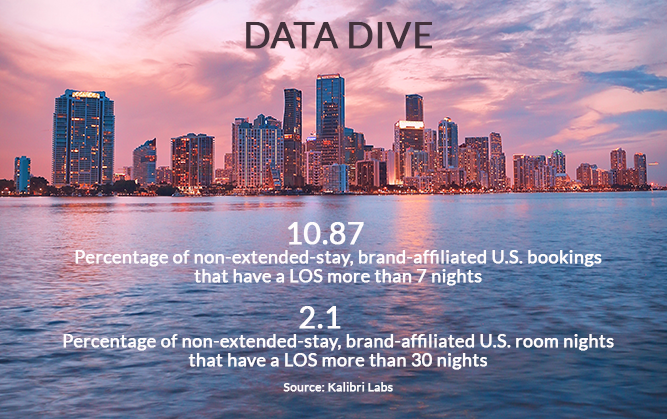

In this traditional approach, limited quantifiable demand data was used. The underwriting was based on a few averaged top-line metrics for a geographically proximate comp set to forecast the potential top line of the hotel. Critical, tangible, and quantifiable demand data such as length-of-stay, degree of brand loyalty, channel mix, customer acquisition costs and guest relationship scores are typically not factored in, increasing the risk of sub-optimal performance.

A unique, data-driven approach

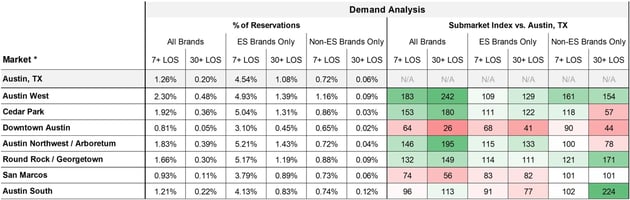

Working hand in hand with the developer, Kalibri Labs took a different approach: the two looked to identify the amount of extended-stay demand currently being served by non-extended stay brands. They then compared the excess demand to the existing extended-stay supply base. In the end, it was realized that the higher the ratio of excess demand to existing supply, the better the market for new extended-stay supply development.

Here’s a step-by-step breakdown of the strategy:

1. Identified all relevant markets in the U.S. filtered by chain scale and removed any impacted by one-time demand or other known issues that would skew the data.

2. Ranked all remaining markets based on quantifiable excess extended-stay demand as measured by extended-stay occupancy at non-extended-stay branded hotels.

3. Indexed the above-average excess demand markets identified in Step 2 ranked based on relative level of demand versus the U.S. average.

4. Assessed the supply landscape based on the percent of room supply made up of extended-stay branded hotels as compared to the total U.S.

5. Calculated a Market Opportunity Index for each market, which is equal to the ratio of the index of the extended-stay demand staying in non-extended stay hotels relative to the U.S. average, divided by the index of extended-stay branded hotel supply in a specific market relative to the U.S. average.

With this methodology, Miami’s Market Opportunity Index ranked 106, meaning there were 105 higher-ranked markets for extended stay development opportunities.

The availability of deeper data insight allowed this developer to gain a more comprehensive approach using the entire U.S. as the total addressable market. They identified and quantified demand metrics and filtered down to the optimal submarket based on consumer demand and preferences, not based on white space and average top-line performance alone.

Because occupancy isn’t the only relevant measure, the two assessed demand based on key measurable factors that allowed the developer to improve due diligence on the front end, when costs are capitalized, minimizing asset management and stabilization costs post-opening.

As evidenced by the Miami project, neither the supply lens nor the demand lens in isolation is optimal. For extended stay evaluation, the key is to find markets with the greatest percentage of extended-stay demand in non-extended stay branded hotels, or the Market Opportunity Index.

Learn more about Kalibri Labs’ Extended Stay Site Selection Report.