New Techniques, Legacy Models And New Entrants Spell Disruption For Distribution class="...

Published Articles

Revenue Strategy: An Emerging Discipline for the Digital Market

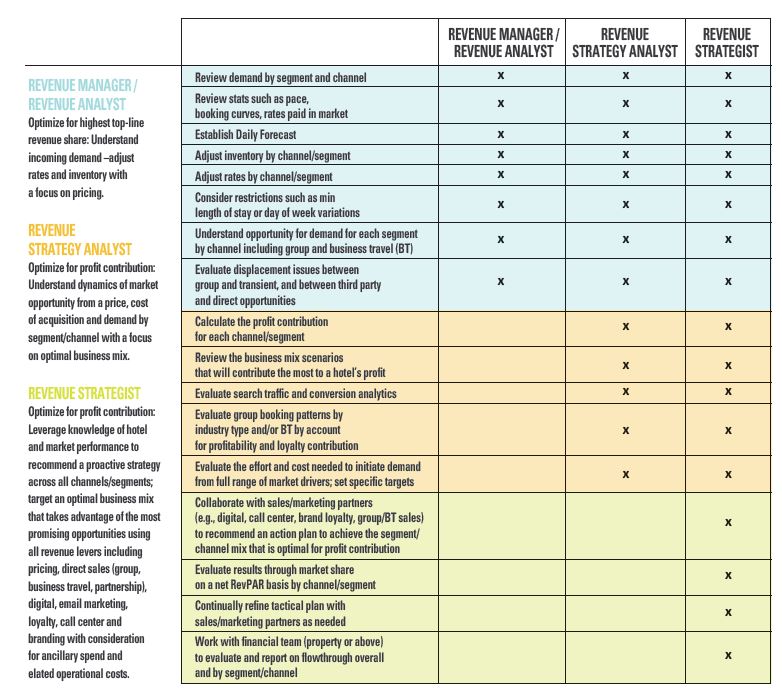

Sustainable profit is the name of the game in a marketplace increasingly dominated by large tech companies. With a renewed focus by brands and management companies on delivering value to hotel owners, there is an urgency for a financial discipline and a proactive approach to integrate revenue planning and execution across channels. Revenue strategy offers an extension to the foundation of revenue management to ride the wave of opportunity afforded by the digital market.

Managing Revenue in the Digital Marketplace

Intermediaries are stealing share while new well-funded third parties that are deeply rooted in the consumer market are entering the travel vertical. Consumers are increasingly savvy when seeking value and convenience. Large companies are consolidating merchandising power – both hotel brands and third parties. On a positive note, demand for hotel stays has improved year over year and guest paid revenue has grown as well. However, costs have grown faster, and hotel profitability cannot keep pace, especially in the event of an economic down cycle.

Experts in revenue management react to incoming demand, and once the expected “end game” for any given day is set, the revenue manager uses tools of inventory control, yield management and pricing to shape the flow of demand and achieve that forecast.

The strategic view calls for proactive business mix planning and decisions about resources deployed, well beyond reacting to what comes over the transom. The insights gleaned from data improve predictability of everything from quality of demand to which products each customer group is likely to purchase. In order to become more agile in leveraging opportunities, hoteliers require deeper cooperation between historically distinct revenue generation functions. That means breaking down silos between disciplines such as call centers, digital, sales, marketing, branding and loyalty. This degree of change may require a new perspective on well-established processes.

Revenue strategy can be a useful concept to catalyze that change, but it is not simply a new name for revenue management. With an eye on costs and multichannel planning, the goal is to improve profit contribution, a metric that resonates with owners whose investment thesis depends on rising asset values. Increased profit contribution can lead to improved investment in staffing, product improvement and new development, which will ultimately benefit consumers and create a healthier lodging ecosystem. While all channels should be considered when planning a hotel’s optimal business mix, increased dependence on third parties is a triple threat to large brands, small brands and independent hotels alike:

1.) Brand dilution through commoditization of hotel rooms,

2.) Diminished relationships with customers

3.) Increased costs with little control, particularly in down cycles.

New Targets of Opportunity

Widening the lens to look at the full array of demand drivers, their associated costs and establishing a hotel’s optimal business mix will require coordination between the revenue functions around the profit contribution goals of the property. When a revenue manager depends only on yield management and pricing tools, it may deliver incremental gains of 2 percent to 5 percent. With an expanded remit to evaluate all demand drivers and associated costs, revenue strategists are hunting for bigger wins. Besides the pricing dial, the revenue strategist will work on channel mix to reduce overall acquisition costs and with sales, digital or other members of the team to grow specific market segments that show the most promise in a given timeframe. At 15 percent to 25 percent of guest-paid revenue, revenue strategists will add new dimensions to the process when they measure and manage customer acquisition costs in a similar manner to labor costs as well as coordinate the game plan to achieve a hotel’s optimal business mix.

OTAs and Brand.com

The simple drive to a two-channel shift from OTA to Brand.com is from a bygone era. Instead, a broader evaluation of volume and margins by channel and segment will direct the strategist to tradeoffs that put a premium on recurring revenue streams to hit targeted profit and flowthrough. Although a powerful contributor to profit, Brand.com has its own costs driven by the chokehold of auction models in metasearch, while some OTA commissions may decline as they face intense competition from new entrants like Airbnb, Facebook and others.

It will take vigilance to frequently assess the combinations of all channels, by segment, day of week or season, that ultimately yield the most contribution to profit on a daily basis. Performance evaluation on top-line revenue can obscure hefty acquisition costs and blur the ability to accurately choose the best options for improving a hotel’s revenue flowthrough. The goal is for better informed decisions, but the strategist recognizes that market conditions may occasionally modify a pure profit focus (e.g., renovations underway, existing base of business can’t be moved, or unusual circumstances call for a different approach).

image-block-outer-wrapper

layout-caption-below

design-layout-inline

combination-animation-none

individual-animation-none

individual-text-animation-none

"

data-test="image-block-inline-outer-wrapper"

>

sqs-block-image-figure

intrinsic

"

style="max-width:782px;"

>

sqs-block-image-button

lightbox

"

data-description=""

data-lightbox-theme="dark"

>

View fullsize

class="image-block-wrapper"

data-animation-role="image"

>

>

Some Organizational and Technology Disconnects

The well-developed expertise of revenue management is essential, but it is one leg of a stool in a complex and costly marketplace. After all, the rates may be set correctly, but the hotel can still underperform relative to profit contribution due to a suboptimal mix.

Although comfortable with pricing issues, few revenue managers have experience with or authority over the rest of the sales and marketing mix. In many brands, the regional teams assigned for sales, marketing and revenue management may even support different clusters of hotels, challenging their ability to integrate between key disciplines. Further, while technology can trigger hourly pricing updates, tactical execution tools for targeted, timely and well-coordinated cross-channel merchandising and promotion are not yet in widespread use.

From the finance team’s perspective, how often do they complain about the high cost of third parties and then cut bonus checks to staffers who produce the most revenue from these same accounts?

The days of depending on a revenue manager to figure it all out are giving way to a revenue strategy team (on property or above property), but the buck still stops at local management who can assure resources are closely aligned with demand and optimized for the profit contribution to their owners. Revenue strategists are the orchestra leaders that assess the opportunities within the context of profit contribution and enable efficient deployment by the appropriate specialist, whether it is sales, digital, loyalty or others.

Summary

The strong demand of recent years can mask deficiencies in process and execution, and one notable symptom that can be linked directly to this phenomenon is underperformance in hotel rate growth in spite of a rising tide since the last recession. The industry can’t sustain fragmented execution and high customer acquisition costs and remain healthy. Beyond the cost factor, some third-party channels undermine the value of the brand by diverting the consumer away from the hotel as they shop, buy and even when they interact with the hotel on-site.

Signs of change are on the horizon as evidenced by the availability of new merchandising technologies, an increased appetite to tap data for insights well beyond pricing and a new sense of urgency to break down silos and focus on efficient customer acquisition. Revenue strategy is emerging as a key discipline to optimize the flowthrough to profit and steer the industry to better outcomes for two key constituents: consumers and hotel owners.