Blog

US lodging industry’s key performance metrics show more growth ahead in 2023

As we move into 2023 it seems the US lodging Industry’s key performance metrics are setting up in a way that implies there is more growth ahead. While demand has not fully recovered to pre-pandemic levels, ADR acceleration has more than made up for it, resulting in RevPAR results well above those registered in 2019.

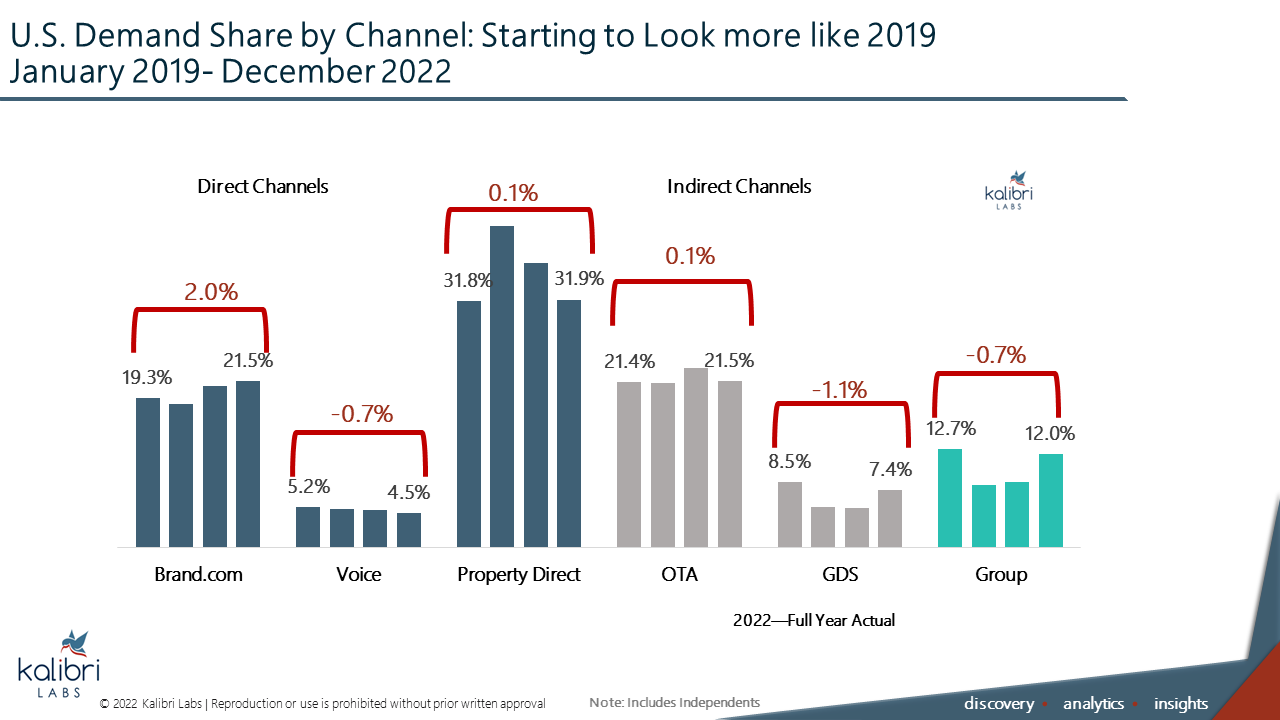

One reason for optimism for continued overall improvement in these metrics is the improving mix of demand that began in 2022 and we expect to continue into 2023. As has been well documented, the initial driver of the industry’s recovery has been the transient leisure traveler with both transient business and group being much slower to recover. One way to measure this is to look at booking patterns by channel. Focusing on the transient business traveler, one of their primary (but not exclusive) booking channels is the GDS. As the chart below shows, the overall percentage of room night booking thru that channel is still well below 2019 levels.

A couple of other factors to consider when evaluating that channels production are:

- The percentage of total demand is recovering, but not back yet.

- With over all lodging demand in 2022 still below the previous peak, the actual percentage demand booked thru this channel is based on a smaller base.

While group is not technically a booking channel, the attached chart highlights the overall percentage of demand that is identified as group. Again, in 2022 group demand continued to lag, from a recovery standpoint much like business transient demand.

However, in looking toward 2023, absent any external shocks to the economy it is my expectation that both business transient demand and group will recover this year and exceed pre-pandemic levels by the end of the year.